Standard ROI formulas are fundamentally flawed because they ignore critical liabilities and opportunity costs, leading to dangerously optimistic projections.

- A true financial model must expense the owner’s market-value salary and build a cash reserve for future capital expenditures (CapEx).

- The investment’s viability depends on its risk-adjusted return exceeding passive market alternatives, like the S&P 500, by a significant margin.

Recommendation: Stop calculating simple ROI. Instead, build a comprehensive pro-forma financial statement that stress-tests cash flow, accounts for terminal value, and quantifies all hidden operational costs from day one.

For any detailed-oriented investor, the primary question regarding a franchise is its return on investment (ROI). The common approach involves a straightforward formula: divide the projected net profit by the initial investment. This method is simple, clean, and dangerously incomplete. Most spreadsheets and back-of-the-napkin calculations ignore the financial realities of running a business, creating a misleading picture of profitability. They fail to account for the most significant hidden costs: the value of the owner’s own labor and the inevitable decay of capital assets.

Standard advice often mentions royalties and marketing fees, but rarely forces an investor to confront the deeper financial truths. What is the opportunity cost of your 60-hour work week versus a corporate salary? How much cash must be set aside from year one to replace a failing HVAC system in year seven? These are not minor details; they are core liabilities that can erode, and often eliminate, a seemingly positive ROI. The core issue is a failure to differentiate between an income-generating job and a capital-appreciating asset.

This analysis moves beyond the platitudes. The objective is not to find a franchise with a high “paper ROI” but to construct a financial model that reveals its true, risk-adjusted return. We will deconstruct the calculation to factor in non-obvious expenses, model worst-case cash flow scenarios, benchmark against passive investments, and understand how the business model itself dictates financial stability. This is not about being pessimistic; it is about being a precise, unsentimental financial modeler. Only by quantifying all variables can you determine if a franchise is a sound capital investment or merely an expensive way to buy yourself a demanding job.

The following sections will guide you through building a more robust financial model, breaking down each critical component to ensure your projections are grounded in financial reality, not just franchisor optimism. This structured approach provides the framework needed to make a disciplined investment decision.

Summary: A Modeler’s Framework for Accurate Franchise ROI

- The “Free Labor” Fallacy: Why You Must Deduct Your Own Salary to Calculate True ROI?

- The J-Curve Effect: How Deep Will You Go into Debt Before Breaking Even?

- Depreciation is Real Cash: Why You Need a CapEx Reserve Fund from Year 1?

- Franchise vs S&P 500: Is the Active Risk Worth the Extra 5% Return?

- Cash Flow vs Equity Build: How the Resale Value Changes Your Total Return Calculation?

- Are Franchisor-Partnered Lenders Actually Offering Better Rates Than Your Local Bank?

- The 50% Rule: When to Stop Fixing That Old Oven and Buy a New One?

- Why Service Franchises with Subscription Models Offer Better Cash Flow Than Retail?

The “Free Labor” Fallacy: Why You Must Deduct Your Own Salary to Calculate True ROI?

The most common and critical error in a preliminary ROI calculation is treating the owner’s time and effort as free. A business that only generates profit because its primary operator works for nothing is not a profitable business; it is an under-compensated job. To accurately assess the investment’s return, the model must treat the owner’s compensation as a non-negotiable operating expense. This figure should not be an arbitrary number but a calculated opportunity cost representing the fair market salary, including benefits, that you are forgoing by not taking a corporate role.

For a model to be valid, you must first determine what your labor is worth. If you could earn a $90,000 salary plus benefits in a comparable management position, that amount must be deducted from the franchise’s projected earnings before any “profit” is calculated. Only the cash flow remaining *after* this deduction represents the actual return on your invested capital. Ignoring this step conflates return on labor with return on investment, making it impossible to evaluate the asset’s performance objectively.

Many franchisees discover too late that their 15% projected ROI was entirely dependent on their own unpaid 60-hour work weeks. Once a market-rate salary is factored in, that “return” often vanishes or becomes negative. The goal of a franchise investment should be to generate returns that significantly outperform what you could earn by simply investing your capital in the market and taking a salaried job. Without expensing your own labor, this fundamental comparison is impossible. A conservative ROI estimate for a franchise might be 10-15%, but this is only meaningful after all costs, including your own salary, have been fully accounted for.

Your Action Plan: Calculating True Owner Compensation

- Determine your fair market value: Calculate what you could earn in corporate employment, including a baseline salary (e.g., $60,000) and any industry-specific premiums.

- Add the value of forgone benefits: Quantify the cash value of healthcare plans, retirement contributions, and potential bonuses you are giving up.

- Calculate expected third-year income: Project the franchise’s income before owner compensation, using a conservative figure based on franchisee disclosure documents (FDDs).

- Subtract your fair market compensation: Deduct your total calculated value (Step 1 + Step 2) from the projected income (Step 3) to determine the true return on your invested capital.

The J-Curve Effect: How Deep Will You Go into Debt Before Breaking Even?

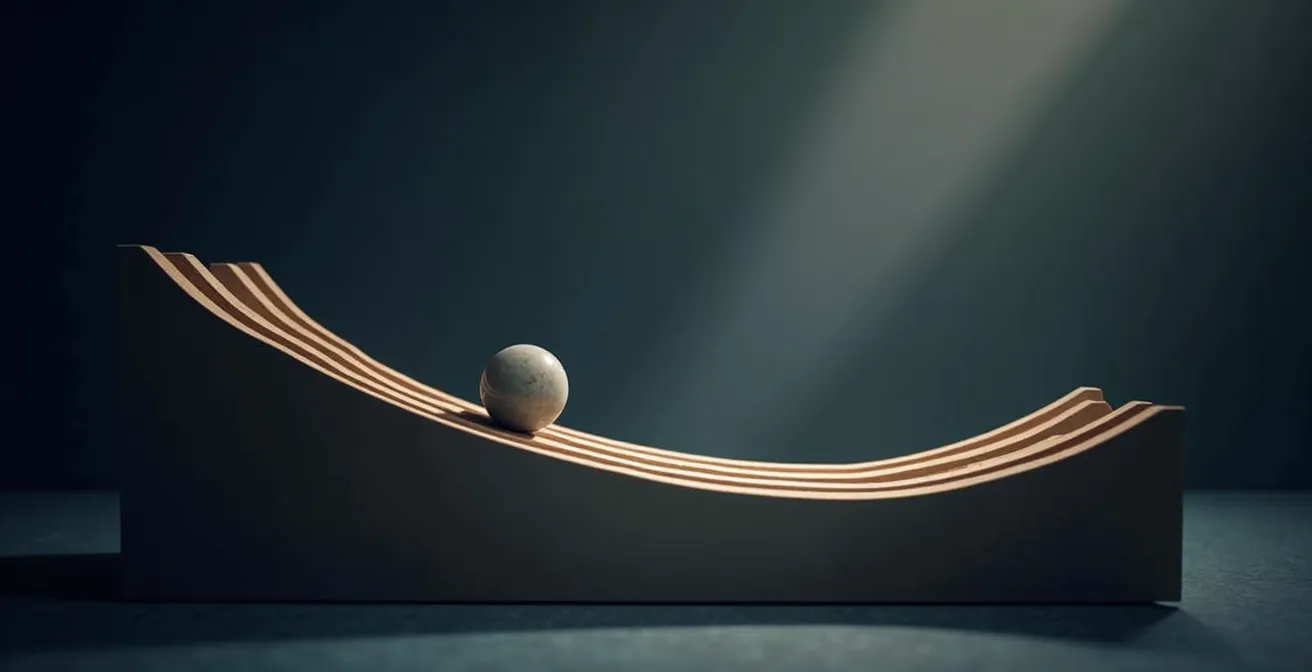

Every new business venture follows a predictable cash flow pattern known as the J-Curve. It begins with a significant cash outflow (the initial investment), followed by a period of negative operating cash flow as expenses outpace revenue. This trough represents the deepest point of your business’s indebtedness before it, hopefully, curves upward toward breakeven and profitability. The critical modeling question is not *if* you will enter this trough, but how deep it will be and how long you will stay there. Underestimating this phase is the primary cause of early-stage business failure.

Franchisor projections are often optimistic. A responsible financial model must stress-test these assumptions. While industry analysis reveals that most franchises reach profitability within 3 years, your model must account for the possibility of delays. What happens to your cash reserves if breakeven takes 3.5 years instead of 3? You must build a scenario that models a 6-to-12-month delay beyond the franchisor’s timeline and calculate the additional working capital required to survive that extended trough.

As the visual representation of the J-Curve shows, the initial descent is sharp and the climb back to profitability can be slow. A proper model includes a contingency buffer of at least 20-30% above the estimated working capital needs. This is not “extra” money; it is a calculated reserve to fund a deeper- or longer-than-expected cash flow trough. The financial stability of the franchisor itself is another key variable; reviewing their financial statements is crucial to assess the risk of the entire system faltering while you are at your most vulnerable point in the curve.

Depreciation is Real Cash: Why You Need a CapEx Reserve Fund from Year 1?

On an income statement, depreciation is an abstract, non-cash expense used for tax purposes. In a real-world financial model, it is a direct proxy for a future cash liability. Every piece of equipment, from POS systems to delivery vehicles, has a finite useful life. The “depreciation” your accountant records is the slow decay of your assets, and that decay will eventually require a large cash outlay for replacement. A model that doesn’t actively fund a Capital Expense (CapEx) reserve from the first year is building on a foundation of inevitable future debt.

You cannot simply hope that cash flow will be sufficient in year five when your primary oven or HVAC system fails. The CapEx reserve is a dedicated, separate fund where you systematically save for these predictable replacements. For example, in a car detailing franchise, the high-pressure washers and steam cleaners that are part of the initial investment will not last forever. Factoring their replacement cost into your ROI calculation from the start is the only way to reflect true, long-term profitability. This transforms depreciation from an accounting entry into a strategic cash management tool.

A detailed cash flow projection must include a line item for monthly or quarterly transfers into this reserve fund. The amount should be based on the expected useful life of your major assets. This requires a granular approach, as different types of equipment have vastly different lifespans and replacement costs.

The following table, based on data from analysis of hidden franchise costs, provides a framework for estimating the annual reserve needed for different asset categories. Failing to account for these cycles means your business’s “profits” are actually just borrowing from its own future.

| Equipment Type | Useful Life | Annual Reserve % | Replacement Cost Impact |

|---|---|---|---|

| HVAC Systems | 10-15 years | 6-10% | Major capital expense |

| Kitchen Equipment | 7-10 years | 10-14% | High – affects operations |

| POS/Technology | 3-5 years | 20-33% | Critical for efficiency |

| Vehicles | 5-7 years | 14-20% | Essential for service franchises |

| Furniture/Fixtures | 5-10 years | 10-20% | Moderate – affects ambiance |

Franchise vs S&P 500: Is the Active Risk Worth the Extra 5% Return?

A franchise ROI figure is meaningless in a vacuum. A projected 15% return might seem attractive, but it must be evaluated against its opportunity cost—specifically, the return you could achieve through passive, low-effort investments. The most common benchmark for this is an S&P 500 index fund, which has historically provided an average annual return of around 10% with zero labor and high liquidity. Therefore, a franchise must offer a significant premium over this benchmark to justify its immense active risk and workload.

To make a rational decision, you must quantify this premium. Most franchise investment experts recommend a 15-20% minimum ROI as the target to justify the investment over passive market returns. If your detailed, stress-tested model projects a 12% return, the logical conclusion is that the investment is not viable. You would be financially better off putting your capital in an index fund and avoiding the 80-hour work weeks, operational headaches, and concentrated risk of a single business.

This comparison requires a cold, unsentimental look at the fundamental differences between these two asset classes. A franchise offers direct control but demands significant labor and is highly illiquid. The stock market offers no control but requires no labor and is instantly liquid. Your financial model must honestly assess whether the potential for a higher return is worth the trade-offs in risk, effort, and flexibility.

This comparative analysis, outlined in a framework adapted from data on typical franchise returns, is a mandatory step in any serious due diligence process. It forces you to justify why taking on active, concentrated risk is superior to a diversified, passive strategy.

| Factor | Franchise Investment | S&P 500 Index Fund |

|---|---|---|

| Risk Profile | Concentrated in single business | Diversified across 500 companies |

| Labor Input | 60-80 hours per week | Zero hours required |

| Liquidity | 6-12 months to sell + broker fees | Instant sale capability |

| Control Level | Direct operational control | No control over companies |

| Tax Advantages | Business deductions, depreciation | Capital gains treatment only |

| Typical Returns | 15-50% (highly variable) | 10% historical average |

Cash Flow vs Equity Build: How the Resale Value Changes Your Total Return Calculation?

Many franchise owners focus exclusively on annual cash flow (profit) as the sole measure of return. This overlooks a critical component of the investment’s total value: the equity being built in the business itself. The ultimate financial outcome of your investment is not just the sum of annual profits, but also the net proceeds you receive upon selling the business. This exit price, or terminal value, must be factored into a comprehensive Total Return on Investment (TROI) calculation.

Calculating TROI requires you to project the business’s future valuation. This is typically done using an industry-standard multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). For many service and retail franchises, a multiple of 2-3x annual EBITDA is a common starting point for valuation. For example, a business generating $100,000 in EBITDA might be valued at $200,000 to $300,000 upon resale. This potential capital gain is a significant part of your overall return.

The calculation is a multi-step process that looks beyond a single year’s performance:

- Sum All Net Profits: Tally the net profits (after your own salary and CapEx contributions) over your intended holding period (e.g., 5-7 years).

- Estimate Business Valuation: Apply a conservative EBITDA multiple (e.g., 2.5x) to the projected EBITDA in your final year of ownership.

- Subtract Remaining Debt: From the projected sale price, subtract any outstanding business loans to find your net proceeds.

- Calculate Total Returns: Divide the sum of total profits plus net sale proceeds by your initial capital investment.

- Factor in Agreement Term: The valuation is heavily impacted by the remaining term on the franchise agreement. A business with only two years left is far less valuable than one with ten years, as a new owner faces an impending renewal fee and uncertainty.

This approach provides a more complete picture, showing how the investment performs both as an income-generating vehicle and as a capital asset that appreciates over time.

Are Franchisor-Partnered Lenders Actually Offering Better Rates Than Your Local Bank?

When financing a franchise, the path of least resistance often leads to a lender partnered with the franchisor. They understand the business model, and the approval process is typically streamlined. However, convenience can mask significant underlying risks and costs. An independent financial modeler must question whether this convenience comes at the price of competitive rates and, more importantly, financial privacy. A local bank, while requiring more effort to educate about the franchise, provides a critical firewall.

Franchisor-partnered lenders may have arrangements that are not fully transparent. Their rates may appear competitive, but this can sometimes be offset by other factors. The most significant risk is the lack of privacy. If your business begins to struggle, a partnered lender may be obligated to share that information with the franchisor, potentially triggering default clauses in your franchise agreement. A local bank has no such obligation; your financial relationship is completely separate, giving you more room to maneuver during difficult periods.

Furthermore, a local bank’s rigorous due diligence process, while slower, can act as a free second opinion on the viability of your business plan. If an independent third-party lender is hesitant to finance your venture, it should be considered a major red flag. The total investment for a franchise can be substantial, as industry research shows a typical franchise fee range of $10,000 to $50,000 can easily scale to a total investment ten times that amount. Given these stakes, the perceived speed of a partnered lender may not be worth the loss of confidentiality and negotiating leverage.

Key Takeaways

- True ROI calculation must deduct the owner’s fair market salary as a real operating expense to separate return on labor from return on capital.

- Franchise returns must be benchmarked against passive investments like the S&P 500; they must offer a significant premium (e.g., 5-10% higher) to justify the active risk and labor.

- A financial model is incomplete without a CapEx reserve fund for future equipment replacement and a terminal value calculation that projects the business’s resale value.

The 50% Rule: When to Stop Fixing That Old Oven and Buy a New One?

In any asset-heavy business, a recurring operational question is whether to repair aging equipment or replace it. The decision cannot be based on gut feeling; it requires a simple but powerful financial framework. The 50% Rule provides a clear, quantitative guideline: if the cost of a repair exceeds 50% of the cost of new, comparable equipment, you should always replace it. This rule prevents you from throwing good money after bad into an asset at the end of its useful life.

The calculation, however, must be more sophisticated than just comparing the repair quote to the new unit’s sticker price. A true model incorporates associated costs. First, add the estimated revenue lost due to downtime during the repair. Second, factor in the potential energy efficiency savings a new, modern unit might offer over the next 1-2 years. When these factors are included, a repair that initially seems cost-effective often reveals itself to be the more expensive long-term option.

This logic extends beyond physical equipment. The 50% Rule can be applied conceptually to other underperforming “assets,” such as outdated processes or even chronically underperforming employees whose cost of retraining and management exceeds 50% of the cost of hiring and training a replacement. Hidden ongoing costs, such as mandatory equipment upgrades dictated by the franchisor or renewal fees of $10,000-$15,000, must also be factored into this lifecycle analysis. These mandated expenses can force a replacement decision and significantly impact your ROI projections.

Why Service Franchises with Subscription Models Offer Better Cash Flow Than Retail?

Not all franchise models are created equal from a cash flow perspective. The underlying business structure has a profound impact on financial predictability and stability. Service-based franchises, particularly those with recurring or subscription revenue models, demonstrate fundamentally superior cash flow characteristics compared to traditional retail operations. This is due to two primary factors: predictable revenue and the absence of physical inventory.

A subscription model (e.g., monthly pest control, lawn care, or cleaning services) provides a baseline of predictable, recurring revenue. This stability is highly valued by banks and potential buyers, as it reduces the risk associated with unpredictable daily foot traffic. A retail model, by contrast, is subject to seasonality, competition, and changing consumer whims. The difference in revenue quality is stark; according to Restaurant Business data, the average unit volume (AUV) for a McDonald’s franchise is $3,505,000, while a more impulse-driven retail food concept like Cinnabon has an AUV of just $295,000. While not a perfect subscription comparison, it highlights the value of consistent, high-frequency demand.

Moreover, service franchises eliminate the single largest drain on a retailer’s working capital: inventory. An inventory-free model means capital isn’t tied up in physical goods that can spoil, become obsolete, or be stolen. This capital can instead be deployed for marketing, expansion, or strengthening the CapEx reserve. This structural advantage leads to more stable cash flow, better financing terms, and ultimately, higher valuation multiples at the point of sale. When modeling a franchise investment, the very nature of its revenue model is a primary variable for assessing risk.

To build a defensible investment thesis, your next logical step is to apply these financial modeling principles to your specific franchise target. Begin by deconstructing the franchisor’s financial performance representations and rebuilding them from the ground up, with every hidden cost and opportunity cost made explicit.